The seismic shift occurring within the financial industry, courtesy of fintech, is rapidly changing our interaction with money. Spearheading this transformation is User Experience (UX) design, a pivotal component of fintech’s appeal and success. That’s why we’ve written this guide to serve as a guiding light for fintech product managers, UX professionals, and freelancers on the quest to master fintech UX design. With Userbrain, a trusted ally in fintech UX testing, success is closer (and easier!) than you might think.

Start testing in minutes and get results within hours. Tap into our pool of 150k+ testers and watch videos of users interacting with your product on their devices. Discover what’s working for your product, and what’s not!

Start your free trialThe role of UX Design in fintech’s success

Gone are the days of long queues at your local bank branch. Powered by UX design, the fintech revolution has reshaped our financial interactions. Compared to traditional banks that are slowly catching up, fintech startups lead the charge in UX innovation, providing intuitive, efficient, and user-friendly apps.

Key fintech UX design trends for 2023

As we journey through 2023, several key trends are defining the fintech UX landscape. These trends, shaped by user expectations, technological advancements, and creative innovation, have positioned fintech UX design as a dynamic and evolving field.

Here’s a snapshot of the current key trends:

- Gamification: Sprinkling fun into finance. Engaging features and rewards transform the otherwise tedious task of money management into an enjoyable activity.

- Product Identity: More than a tool, your app represents your brand. A distinctive and memorable UX can set you apart in the crowded fintech marketplace.

- Centralization: Convenience is king. Providing a comprehensive financial overview through third-party service integration, all in one place, satisfies users’ cravings for simplicity.

- Fully Mobile Banking: Rapid access to finances on-the-go. A mobile-first design approach reduces bureaucracy and facilitates access.

- Social Banking: Fostering shared financial experiences. Merging social networking and banking allows users to manage their finances collaboratively.

- Data Visualization: Unraveling insights at a glance. Visual representations make complex financial information more digestible.

- Human Language: Simplification is the new sophistication. Getting rid of financial jargon makes your app more accessible to everyone.

Examples of successful fintech UX design

Now let’s see these trends in action through fintech apps that are getting UX design right.

Wise – product identity & centralization

Leading the charge is Wise, a London-based fintech star that has evolved from a simple money transfer service into a comprehensive financial solution provider. Wise has embraced product identity, creating a user-centric interface that stands out in the crowd.

Their centralization of services, like ‘Wise Business’ and ‘Wise Platform,’ make them a one-stop solution for financial needs. Wise’s commitment to ongoing improvements and adjustments, guided by actual user feedback, makes them an ideal embodiment of the social banking trend, showcasing how a fintech product can effectively prioritize its users’ needs.

George – fully mobile banking & human language

George epitomizes the trend of fully mobile banking and human language. Their app combines simplicity and personalization, making financial management a breeze. By combining a mobile-first approach with natural language, George fully embodies mobile banking and human language to provide a perfect fintech user experience for users of all demographics.

Revolut – centralization & data visualization

Then we have Revolut, the UK-based fintech powerhouse offering an array of financial services with an aesthetically pleasing and user-centric interface. Revolut excels in centralization, offering an array of financial services in one place. Their data visualization is top-notch, and their use of human language is exceptional. What more could you ask for?

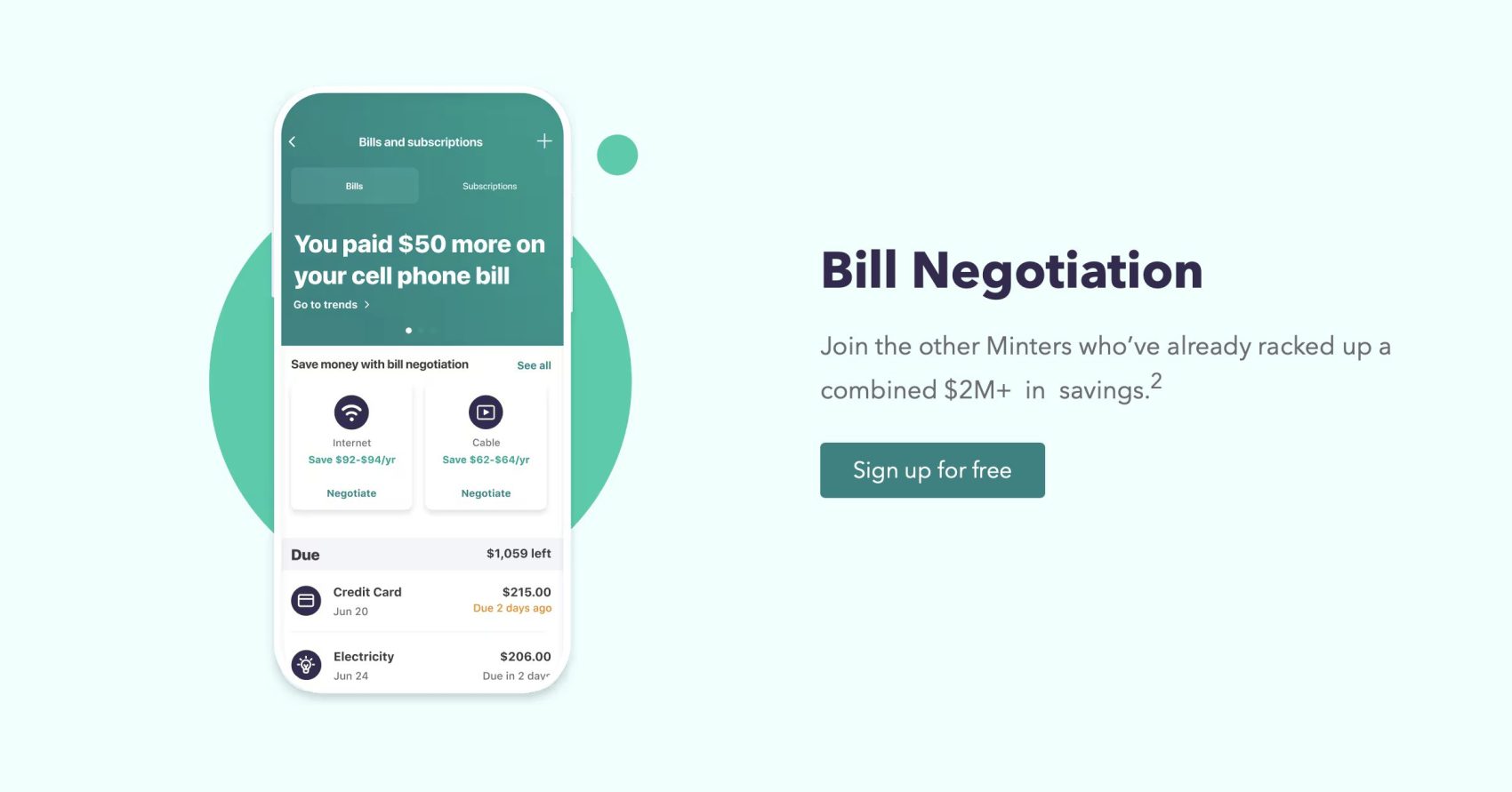

Mint – gamification

However, Mint takes the crown for gamification. Their interactive educational tour makes learning about personal finance engaging and fun. Their data visualization and human language features simplify complex financial information.

The Mint UX product team has also been successful in simplifying financial language, culminating in a perfect example of the human language trend. Their product also serves as a reminder of the importance of consistency across platforms, whether that be mobile, tablet, android, iOS, or something completely new.

Mastering Fintech UX Testing with Userbrain

For fintech, good UX is more than a desirable feature—it’s a necessity. However, creating an exceptional user experience demands constant testing, refining, and iteration. That’s where Userbrain comes in.

Userbrain is a potent tool for fintech UX design testing, providing a platform for continuous testing of your fintech app, website, or product with real people. Providing access to a global community of over 100,000 testers, Userbrain allows you to test with a diverse range of users, offerering invaluable qualitative insights that can help you create the optimal fintech UX for your users.

Userbrain’s features are designed to help fintech product managers and freelancers test their work effectively and efficiently, helping you to identify what works, what doesn’t, and what can be done better.

Additionally, due to Userbrain’s progressive pricing model, you’ll be able to find the right user testing plan for your product, whether you’re a fledgling fintech startup or a key player in the financial world.

7 fintech user testing strategies for success

Now we’ve established that user testing should be an integral part of your product development workflow, you’ll need to learn how to create user tests for your fintech product. Here are some practical strategies, tips, and best practices to help you create user tests that are tailor-made for the unique needs of the fintech and banking industries:

1. Set Clear Objectives

Be crystal clear about what you want to achieve with each user test. Decide on the specific aspects of your fintech or banking product that you want to evaluate, such as how users navigate the onboarding process, complete transactions, or ensure data security. Having clear objectives will help you focus your user tests and gather valuable insights.

2. Design Realistic Scenarios

Craft user scenarios that feel like real-life situations your target users would encounter when using your fintech or banking product. For example, simulate scenarios like sending money to a friend, paying bills, making investment decisions, or managing accounts.

Realistic scenarios – like the one created for this user test for Western Union – allow users to provide feedback based on their actual needs and experiences.

3. Test Across Different Platforms

Fintech and banking products often run on various platforms, like websites, mobile apps, or tablets. Make sure your user tests cover all relevant platforms to evaluate how consistent the user experience is across different devices. Test things like responsiveness, ease of navigation, and overall functionality on each platform to uncover any platform-specific issues.

4. Pay attention to security

Given the sensitive nature of financial transactions and user data, it’s crucial to include security testing in your user tests. Evaluate how users perceive security features like authentication methods, data encryption, and fraud prevention measures. Check if users feel confident in the security of the platform and if they understand the security measures in place.

5. Don’t rely solely on numbers

In fintech and banking, numbers can only tell part of the story. While quantitative data provides metrics like success rates and completion times, it’s crucial to gather real user feedback for a comprehensive understanding. Interestingly, the user feedback that you gather will most likely explain your quantitative data.

Hence, numbers provide insights into the “what,” but user feedback uncovers the “why.” Embrace the human side of user testing to unlock meaningful insights that drive the success of your fintech or banking venture.

6. Consider compliance and regulations

Fintech and banking products often need to comply with specific regulations, like data privacy laws or accessibility standards. Incorporate tests that ensure your product meets these requirements and provides an inclusive experience for all users.

7. Keep learning and improving

User testing is an ongoing process. Continuously learn from user feedback and insights gained through testing. Use the results to prioritize improvements and validate design decisions. This iterative approach allows you to fine-tune the user experience and create a product that truly meets the needs and expectations of your users.

By following these tips and customizing your user tests to the specific characteristics of fintech and banking products, you can gather valuable insights that will guide the development and enhancement of your product, resulting in a user-centered and successful fintech or banking experience.

Conclusion – UX design is essential to fintech

The fintech revolution is here, and UX design is front and center. Mastering fintech UX design and its subsequent testing can be your differentiator in a fiercely competitive market. Leveraging the latest design trends while staying true to your product’s core values is crucial for a winning fintech UX.

Remember, designing is just the beginning. The true test of a great fintech UX lies in the hands of your users. Userbrain provides a testing platform that empowers you to understand your users and build a fintech UX that not only meets their needs but delights them at every touchpoint.

Embrace the journey of mastering fintech UX design and testing with Userbrain, your reliable partner in creating a truly successful fintech product.